I love loyalty programmes and credit card rewards because they have transformed my travel experiences. If you follow MuslimTravelGirl, you will know I always encourage you to make a habit of using reward points in your daily life to maximise your savings and travel more.

Here is how exactly use reward point stacking in the UK, a market that sadly is not as generous as the USA but still a great way to earn daily. Because, in the end, every little helps. (it totally sounds like a Tesco advertisement)

Recently I did a masterclass on the Saudi Airlines loyalty programmes (sign up for my newsletter for more), and the one thing I kept going on about is making points accumulation and reward stacking part of your daily life.

It is not hard to earn rewards once you know how and where to look for them.

This post is for those totally new to this travel hacking game, so skip it if you already know it.

How to Stack Rewards Credit in the UK

Today’s topic will be Nespresso pods (not an ad), just my daily addiction. This is a purchase that pretty much millions make because, you know, coffee is life!

So here is how I stack up rewards to earn points, cashback and discounts.

This is not per see for the saving but the actual mechanics and principles of loyalty programmes and stacking the rewards to maximise your savings. For reference, the box of Nespresso pods cost £4,20 on average, and I ended up getting them for £2,70 and received Avios as well.

These principles apply to any other offer or purchase you might want to make. But it is part of how I accumulate travel points and membership rewards.

1. American Express Offer

My American Express Platinum had an offer of spending £60 and getting £20 back; this is a good return for sure. It gives you 33% back on your shopping.

Now, you can actually go to Nespresso and buy yourself £60 worth of goods and pay £40, but where is the fun in this?

If you are looking to start your loyalty points journey, check out the great offers for the Amex Gold card, which is free for the first year.

In the last few years I have saved over £1400 with my Amex offers and this doesn’t count the unlimited lounge access, insurance claims or spending abroad or the benefits of my platinum card.

2. Nespresso Offer

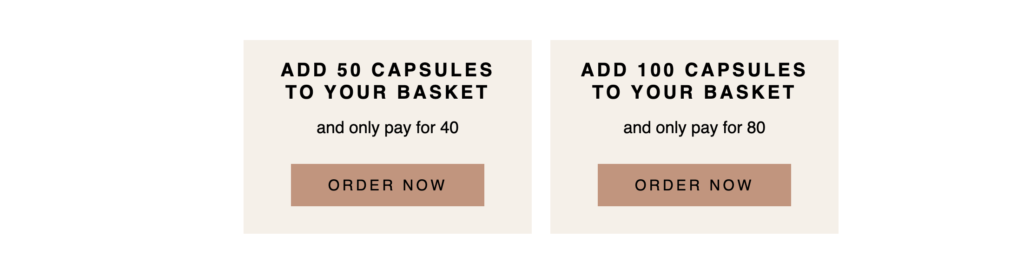

Every few months, Nespresso emails me with an offer for pods and discounts. Usually, it is buy x amount and get x amount free. It is also vital to sign up for emails and rewards from retailers you like.

In this offer, they had, buy 100 pods and get 20 free. Since I was running low on coffee pods and I could stock up for a few months, I decided it was time to combine the offers.

You can go direct and buy the offer, but you will be missing a vital piece of the puzzle.

3. Shopping portal

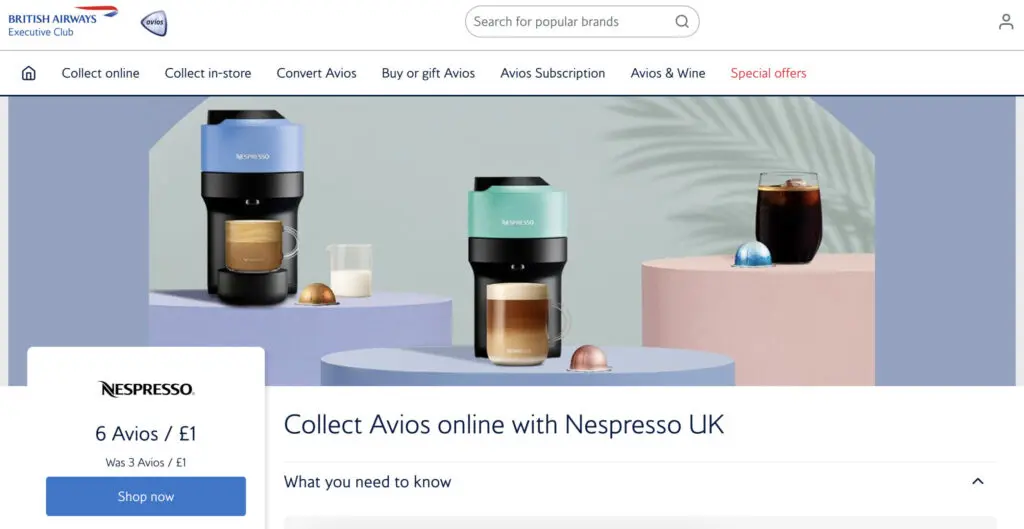

If you have read this article, you know I pretty much always shop via a shopping portal, whether it is Topcashback, Virgin Atlantic(new in the mix) or my beloved BA shopping portal.

I do not make an online purchase without checking some of these websites in order to see who gives me the bigger reward.

This all comes down to strategy and what your plan is for those rewards. Let’s say, in my case; I am looking to top up my Avios account. I will use the Avios portal to stack the rewards.

Usually, Topcashback will be for very big purchases or when the offer is not generous on the other sites.

This way, you can combine all the rewards when making a purchase.

The BA shopping portal was giving 6 Avios per £1 spent 100% extra as the normal is only 3 Avios.

4. Promo Codes

I have downloaded two plug-ins of Honey and Coupert to scan the internet for extra rewards and coupons. This is done automatically and has saved me a few hundred over the past year. Sometimes they do find coupons, and others don’t. It’s ok. It is just an extra saving which is always welcome.

In this option, I didn’t find any extra coupons to use.

How You Combine the Rewards

My first step is, of course, to visit the BA portal after clearing my cookies so it tracks correctly.

I then signed up into my Nespresso account, so it shows my offers of 100 with 20 complimentary pods. I had to reach the minimum spent that was required by American Express in order to trigger the offer of spend £60 get £20.

In the end, I received 6×62 = 360 Avios approximately. Not a large amount, but again every little helps.

This also triggered my Amex offer, so I paid £42 out of pocket and received 42 Amex points as additional rewards on my card.

In total, I bought 172 pods of Nespresso coffee for £42.

This is mostly an example of how you can stack and accumulate loyalty rewards as part of your everyday life without making it a burden on yourself or stressing about it.

Sign-up bonuses are great but especially in the UK market, we don’t have many card options to churn. Also, as a Muslim, I prefer a slow and steady stream of rewards because, at the end of the year, they do add up, making it possible to travel for less.

So next time you think that reward programmes do not work, think about how you can maximise them for your own

Loyalty Programmes and how they work

The Avios Habit – How I have saved thousands redeeming Avios points